新能源重卡渗透率逼近25%!动力电池同步“爆发”

2025年以来,中国新能源重卡市场爆发式增长,成为商用车领域最耀眼的增长引擎。

数据显示,1-11月全国新能源重卡销量达16.1万辆(营运证口径,下同),同比高增189%,增速迅猛。

截至11月,新能源重卡已连续34个月实现同比增长,且连续30个月跑赢重卡市场大盘。业界预计,2025年全年销量有望突破18万辆,新车渗透率将提升至25%。

强劲的发展势头,直接带动重卡动力电池市场需求增长,头部电池企业纷纷加码布局,行业形成“整车高增+电池配套飙升”的双繁荣格局。

值得注意的是,在运价低迷的背景下,短倒、物流等行业企业,仍投入重金购置新能源重卡,推动该市场从两年前5.7%的新车渗透率,猛增至当前的近25%。

这一逆势增长的背后,核心原因有哪些?新能源重卡能否复制新能源乘用车(当前新车渗透率已达50%)的发展历程?

01

多轮驱动,新能源重卡实现高增速、高渗透

数据显示,1-11月全国新能源重卡销量TOP10企业分别是:徐工、三一、解放、重汽、陕汽、福田、东风、远程、江淮和宇通。

数据来源:根据公开数据整理

增速方面,销量TOP10企业中,除宇通外,其它车企增速均超100%,保持高增长态势。

在2025年新能源重卡高增速、高渗透的背后,行业专家揭示了驱动这一趋势的核心动力。

亿纬锂能副总裁、商用车电池产品线总裁江吉兵博士分析认为,“其一是新能源商用车在全生命周期内,展现出了巨大的运营价值、运力价值,与燃油车型形成了鲜明的对比;其二是电池价格下降,让新能源商用车车主首次购车成本,得以大幅下探。”

“商用车主要靠TCO(全生命周期成本)驱动。重卡是生产资料,经济性上,只要TCO算正了,就能快速渗透。目前,短倒场景新能源渗透率已超过50%。”欣旺达动力商用车船事业部副总经理王慧指出,电池降价、维修费用更低、整车续航里程提高、加电量不亏吨、用电比用油更省钱,以及超充普及,让电动重卡使用成本已大幅低于燃油车。

王慧认为,后续商用车领域,尤其是新能源重卡的新车渗透率增长,会比新能源乘用车渗透率增速更快。

可以看到,受益于0.3元-0.5元/kWh的低电价,电池循环寿命提升至超6000次,单次充电时间缩短至15-30分钟,使新能源重卡营运成本远低于燃油车型;随着兆瓦级超充与5分钟换电技术逐渐成熟,也使新能源重卡单日运营效率实现突破。

同时,随着电池能量密度持续提升,重卡纯电续航开始向700公里级迈进(国家工业和信息化部第400批《道路机动车辆生产企业及产品公告》公示中,三一集团申报的一款纯电半挂牵引车,搭载国轩高科超880度电磷酸铁锂电池包,续航里程可达700公里)。

综合上述优势,新能源重卡已从短倒等市场,加快渗透至干线物流这一重卡主战场。

此外,政策激励也使新能源重卡加速普及。

2025年4月,国家交通运输部等十部门联合发布《关于推动交通运输与能源融合发展的指导意见》,首次在国家级政策中提及“推动新能源营运重卡规模化应用”。

另据相关政策,老旧柴油重卡淘汰更新补贴范围,扩大至国四及以下标准,叠加部分地方置换补贴,有效激活了市场需求。

12月10日召开的中央经济工作会议明确,2026年将优化“两新”政策实施,这意味着明年会继续实施国补政策,但具体政策会有所优化,新能源车的相关新政也将受到持续关注。

02

头部电池企业聚焦行业痛点突破与场景适配

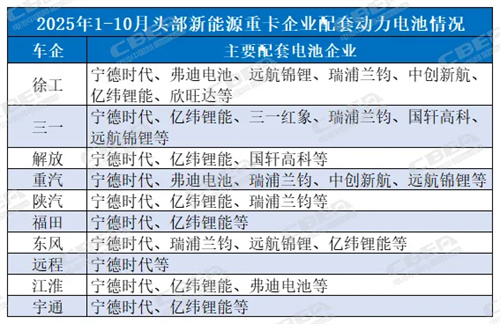

动力电池应用分会数据显示,1-10月头部新能源重卡企业主要配套动力电池情况如下:

可以看到,除宁德时代重卡客户结构丰富外,弗迪电池、亿纬锂能、瑞浦兰钧、国轩高科等电池厂,也凭借自身技术与市场布局,获得多家客户的认可。

值得关注的是,新能源重卡高增长直接带动动力电池装机需求放量,头部电池企业配套布局也越来越清晰,并呈现出行业痛点突破与场景适配双线并进的特点。

宁德时代目标到2030年覆盖全国80%干线运力,已发布75#标准化换电块及全场景换电解决方案,并布局“八横十纵”换电绿网。

针对行业痛点,亿纬锂能商用车电池产品线销售部总经理黄红良近日表示,在实际运营中,亿纬锂能研发的重卡专用电池,旨在通过延长有效运营时间、降低能源消耗、提升载重收益这三大路径,以实现新能源重卡价值提升。

瑞浦兰钧则着力用“大而稳”的电池包设计,根治整车高重心与亏吨难题。

国轩高科通过适配多种电压平台、四枪并充技术,以及覆盖200k-1000kWh宽电量区间,在不同电压平台,实现整车快速补能,并积极推进千度电量电池包,加速装车应用。

而为了提高充电效率、降低总运营成本,欣旺达动力也推出了重卡专用大容量超充、长寿命电池解决方案,可实现15分钟补能10%-80%,以及循环寿命超6000次。其第三代长寿命电池,循环寿命已升至10000次。

当前,新能源重卡正从港口、矿区等封闭场景,向长途干线物流等开放场景加速渗透,应用边界不断拓宽。产业链层面,整车与电池企业合作深化,从电池配套,拓展到联合研发、补能网络共建等。值得注意的是,干线电动化,已提出电池长续航、加电不亏吨、大电量高效补能、TCO价值优化的更高需求,或需整车与电池企业不断创新技术,以巩固自身市场竞争力。

Since 2025, the explosive growth of China's new energy heavy-duty truck market has become the most dazzling growth engine in the commercial vehicle field.

Data shows that from January to November, the sales volume of new energy heavy-duty trucks in China reached 161000 units (according to the operating certificate caliber, the same below), a year-on-year increase of 189%, with a rapid growth rate.

The penetration rate of new energy heavy-duty trucks is approaching 25%! Power battery synchronous' explosion '

As of November, new energy heavy-duty trucks have achieved year-on-year growth for 34 consecutive months, and have outperformed the heavy-duty truck market for 30 consecutive months. The industry expects that the annual sales volume in 2025 is expected to exceed 180000 vehicles, and the penetration rate of new cars will increase to 25%.

The strong development momentum directly drives the growth of demand in the heavy-duty truck power battery market, and leading battery companies are stepping up their layout, forming a dual prosperity pattern of "high vehicle growth+soaring battery matching" in the industry.

It is worth noting that, against the backdrop of low freight rates, companies in the short haul and logistics industries are still investing heavily in purchasing new energy heavy-duty trucks, driving the market from a new car penetration rate of 5.7% two years ago to nearly 25% currently.

What are the core reasons behind this counter trend growth? Can new energy heavy-duty trucks replicate the development history of new energy passenger vehicles (currently with a new car penetration rate of 50%)?

01

Multi wheel drive, new energy heavy-duty trucks achieve high growth rate and high penetration

The data shows that the top 10 companies in terms of sales of new energy heavy-duty trucks in China from January to November are XCMG, Sany, Jiefang, Heavy Duty Truck, Shaanxi Automobile, Foton, Dongfeng, Remote, Jianghuai, and Yutong.

The penetration rate of new energy heavy-duty trucks is approaching 25%! Power battery synchronous' explosion '

Data source: Organized based on publicly available data

In terms of growth rate, among the top 10 companies in terms of sales volume, except for Yutong, all other car companies have a growth rate of over 100%, maintaining a high growth trend.

Behind the high growth rate and penetration of new energy heavy-duty trucks in 2025, industry experts have revealed the core driving force behind this trend.

Dr. Jiang Jibing, Vice President of EVE Energy and President of the Commercial Vehicle Battery Product Line, analyzed that "firstly, new energy commercial vehicles have demonstrated tremendous operational and transportation value throughout their entire lifecycle, forming a sharp contrast with gasoline models; secondly, the decrease in battery prices has allowed new energy commercial vehicle owners to significantly lower their first-time purchase costs

Commercial vehicles are mainly driven by TCO (Total Cost of Ownership). Heavy trucks are means of production, and economically, as long as TCO is calculated correctly, they can quickly penetrate. At present, the penetration rate of new energy in short-term scenarios has exceeded 50%. ”Wang Hui, Deputy General Manager of Xinwangda Power's Commercial Vehicle and Vessel Business Unit, pointed out that the price reduction of batteries, lower maintenance costs, increased vehicle range, no loss of charging capacity, cheaper electricity consumption than oil consumption, and the popularization of supercharging have made the cost of using electric heavy-duty trucks significantly lower than that of fuel vehicles.

Wang Hui believes that in the future, the penetration rate of new commercial vehicles, especially new energy heavy-duty trucks, will grow faster than that of new energy passenger vehicles.

As can be seen, benefiting from the low electricity price of 0.3 yuan to 0.5 yuan/kWh, the battery cycle life has been increased to over 6000 times, and the single charging time has been shortened to 15-30 minutes, making the operating cost of new energy heavy-duty trucks much lower than that of fuel vehicles; With the gradual maturity of megawatt level supercharging and 5-minute battery swapping technology, breakthroughs have been made in the daily operational efficiency of new energy heavy-duty trucks.

At the same time, with the continuous improvement of battery energy density, the pure electric range of heavy-duty trucks has begun to move towards the 700 kilometer level (as announced in the 400th batch of "Announcement on Road Motor Vehicle Production Enterprises and Products" by the Ministry of Industry and Information Technology of China, a pure electric semi-trailer tractor declared by Sany Group is equipped with Guoxuan High tech Super 880 degree lithium iron phosphate battery pack, with a range of up to 700 kilometers).

Taking into account the above advantages, new energy heavy-duty trucks have accelerated their penetration from the short haul and other markets to the main battlefield of mainline logistics.

In addition, policy incentives have also accelerated the popularization of new energy heavy-duty trucks.

In April 2025, the Ministry of Transport and ten other departments jointly issued the "Guiding Opinions on Promoting the Integrated Development of Transportation and Energy", which for the first time mentioned "promoting the large-scale application of new energy operation heavy trucks" in national policies.

According to relevant policies, the scope of subsidies for phasing out and updating old diesel heavy trucks has been expanded to National IV and below standards, combined with some local replacement subsidies, effectively activating market demand.

The Central Economic Work Conference held on December 10th clarified that the implementation of the "two new" policies will be optimized in 2026, which means that the national subsidy policy will continue to be implemented next year, but specific policies will be optimized, and new policies related to new energy vehicles will also receive continuous attention.

02

Top battery companies focus on industry pain points, breakthroughs, and scenario adaptation

According to data from the Power Battery Application Branch, the main supporting power batteries of top new energy heavy-duty truck enterprises from January to October are as follows:

The penetration rate of new energy heavy-duty trucks is approaching 25%! Power battery synchronous' explosion '

It can be seen that in addition to the rich customer structure of Ningde Times heavy-duty trucks, battery factories such as Fudi Battery, EVE Energy, Ruipu Lanjun, and Guoxuan High tech have also gained recognition from multiple customers through their own technology and market layout.

It is worth noting that the high growth of new energy heavy-duty trucks directly drives the increasing demand for installed power batteries, and the supporting layout of leading battery companies is becoming increasingly clear, showing a dual track approach of breaking through industry pain points and adapting to different scenarios.

Ningde Times aims to cover 80% of the country's mainline transportation capacity by 2030. It has released 75 # standardized battery swapping blocks and full field battery swapping solutions, and laid out an "eight horizontal and ten vertical" battery swapping green network.

In response to industry pain points, Huang Hongliang, General Manager of the Sales Department of EVE Energy's Commercial Vehicle Battery Product Line, recently stated that in actual operation, EVE Energy's heavy-duty truck specific batteries aim to increase the value of new energy heavy-duty trucks through three major paths: extending effective operating time, reducing energy consumption, and improving load capacity.

Ruipu Lanjun focuses on using a "large and stable" battery pack design to solve the problems of high center of gravity and ton loss in the entire vehicle.

Guoxuan High tech has achieved rapid vehicle energy replenishment on different voltage platforms by adapting to various voltage platforms, using four gun parallel charging technology, and covering a wide range of 200k-1000kWh battery capacity. It actively promotes the use of thousand kilowatt battery packs to accelerate vehicle installation.

In order to improve charging efficiency and reduce total operating costs, Xinwangda Power has also launched a heavy-duty truck specific high-capacity overcharging and long-life battery solution, which can achieve 10% -80% energy replenishment in 15 minutes and a cycle life of over 6000 times. Its third-generation long-life battery has increased its cycle life to 10000 times.

Currently, new energy heavy-duty trucks are accelerating their penetration from closed scenarios such as ports and mining areas to open scenarios such as long-distance trunk logistics, and their application boundaries are constantly expanding. At the level of the industrial chain, the cooperation between vehicle and battery enterprises has deepened, expanding from battery matching to joint research and development, and joint construction of energy replenishment networks. It is worth noting that the electrification of trunk lines has raised higher demands for long battery life, no loss of tons during charging, efficient replenishment of large amounts of electricity, and TCO value optimization. It may require continuous technological innovation by vehicle and battery companies to consolidate their market competitiveness.